In my

last post I described my good fortune in purchasing stock in Apple and AMD in the late summer of 2002. I did not do a full "Buffet style analysis" of either stock. However in each case I think I took a rather reasonable short cut to the same conclusions.

In the case of AMD I had been casually following the stock for about a decade. Historically AMD's stock price had been very cyclical and by understanding the cycles and what drove them one could make money on AMD in a very non-Buffet like trading pattern. AMD's cycles were driven by its competition position with Intel. (In fact regardless of other revenue streams, the position with relation to Intel seemed to be the only thing driving the stock price.) This knowledge allowed me to have a general idea of when the market was giving AMD an unrealistically low valuation. I also had a friend who

did do a full Buffet style analysis and valuation of AMD and was nice enough to share that with me. Both these factors told me AMD was a good value buy in the summer of 2002. (Note however that it was

down 50% just a few months later.)

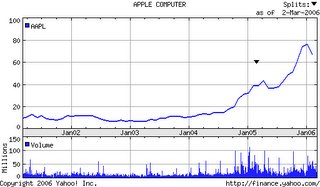

In the case of Apple I invested based on 3 factors:

- Apple had cash equal to about two thirds of its market valuation. This meant that if the price dropped an other 30% someone could have bought the whole company for its cash assets. Any money made by selling off other assets would be profit. (Ignoring any value in the operations.) This put a reasonable floor on any potential loses from an investment in Apple.

- Apple had a small but faithful set of core customers, so I saw no reason to believe all of the rumors of impending doom.

- With OS X released and the iPod out, I thought Apple was in better position than it had been in for many years. OS X meant that Apple has an OS that was once again vastly better than what was available in the Microsoft world. They had in fact done what many companies had failed to do, they made UNIX user friendly! I thought the iPod was an interesting device, but didn't really think it would be nearly as successful as it has been,

To me these factors meant that buying Apple was a "no brainer."

In short it is possible for someone without 40 or 80 hours a week to devote to looking for good companies to buy at excellent prices, to find one. However also as Buffet and Hagstrom would point out, it doesn't happen often so when it does you should load up on the stock. That is my only regret with these two purchases. In my IRA I had little to invest. And my non-IRA account had been badly reduced by risky plays that ended in big loses after the dot com bubble burst and the Sept. 11th terrorist attacks.

I have finished reading

The Warren Buffett Portfolio by Robert G. Hagstrom. It was an interesting book, with many little stories about Buffet, Benjamin Graham, and others. Fairly easy reading about

focus investing. Very little about details of stock analysis as Buffet does, for that information you will have to look else where. It can be summarized as follows: Since you get almost all possible diversification with only 12 holdings, if well selected, there is no reason to hold huge numbers of stocks (like most mutual funds).