Investing Styles

I am now two thirds of the way through The Warren Buffett Portfolio. I realize as I read it that I have at times followed a number of the strategies described, both good and bad. The reason I wanted to read about Buffett's strategy was that I have come to realize I am following it to some degree. I say to some degree, because for Buffett searching for good investments is his day job. I unfortunately have to work a different job during the day and can only spare a few hours a week to tend my portfolio. I plan to expand on implications of that difference in a later posting.

However as I said I have come to understand the some of the truth in Buffett's investing philosophy. I believe that it is one thing to know something, it is another thing to grok it. To understand why it is that I am beginning to grok the Buffett strategy we need to look at my experience managing a modest IRA account.

In the summer of 2002 I moved a small 401(k) account from a previous employer into an online discount trading IRA account. Since 2002 that small account has grown to 4 times its original value. While I have had only a few bad picks and mostly good picks that any fund manager would be proud of, the bulk of that growth is due to just two stocks I bought at the very beginning.

In the summer of 2002 I moved a small 401(k) account from a previous employer into an online discount trading IRA account. Since 2002 that small account has grown to 4 times its original value. While I have had only a few bad picks and mostly good picks that any fund manager would be proud of, the bulk of that growth is due to just two stocks I bought at the very beginning.

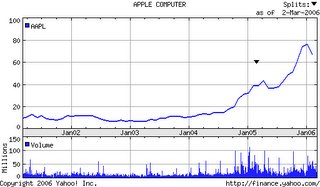

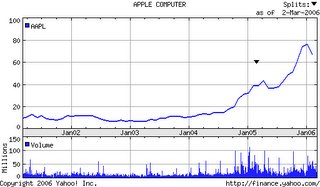

AMD is a stock that I have followed since the early 90's. I bought it for a little under $10 a share during the late summer of 2002. As you can see in the AMD graph from Yahoo to the right, AMD has climbed quiet a bit since then. But Apple has done even better. My Apple purchase is up 882% since then, and peaked just under 1000% a couple of months ago. The AMD purchase is up about 533% to date. Given that performance other stocks that are up 40% or 50% seem like laggards, little better than the stocks I lost money on.

AMD is a stock that I have followed since the early 90's. I bought it for a little under $10 a share during the late summer of 2002. As you can see in the AMD graph from Yahoo to the right, AMD has climbed quiet a bit since then. But Apple has done even better. My Apple purchase is up 882% since then, and peaked just under 1000% a couple of months ago. The AMD purchase is up about 533% to date. Given that performance other stocks that are up 40% or 50% seem like laggards, little better than the stocks I lost money on.

However as I said I have come to understand the some of the truth in Buffett's investing philosophy. I believe that it is one thing to know something, it is another thing to grok it. To understand why it is that I am beginning to grok the Buffett strategy we need to look at my experience managing a modest IRA account.

In the summer of 2002 I moved a small 401(k) account from a previous employer into an online discount trading IRA account. Since 2002 that small account has grown to 4 times its original value. While I have had only a few bad picks and mostly good picks that any fund manager would be proud of, the bulk of that growth is due to just two stocks I bought at the very beginning.

In the summer of 2002 I moved a small 401(k) account from a previous employer into an online discount trading IRA account. Since 2002 that small account has grown to 4 times its original value. While I have had only a few bad picks and mostly good picks that any fund manager would be proud of, the bulk of that growth is due to just two stocks I bought at the very beginning.  AMD is a stock that I have followed since the early 90's. I bought it for a little under $10 a share during the late summer of 2002. As you can see in the AMD graph from Yahoo to the right, AMD has climbed quiet a bit since then. But Apple has done even better. My Apple purchase is up 882% since then, and peaked just under 1000% a couple of months ago. The AMD purchase is up about 533% to date. Given that performance other stocks that are up 40% or 50% seem like laggards, little better than the stocks I lost money on.

AMD is a stock that I have followed since the early 90's. I bought it for a little under $10 a share during the late summer of 2002. As you can see in the AMD graph from Yahoo to the right, AMD has climbed quiet a bit since then. But Apple has done even better. My Apple purchase is up 882% since then, and peaked just under 1000% a couple of months ago. The AMD purchase is up about 533% to date. Given that performance other stocks that are up 40% or 50% seem like laggards, little better than the stocks I lost money on.

0 Comments:

Post a Comment

<< Home